The Chicken or the Egg and Why Should We Care?

June 16, 2016

What comes first – the end of the 100 year love affair with central banking which causes the mass selling of global sovereign (government) bonds or visa versa? They are both the biggest bubbles in the history of mankind and they are adjoined twins.

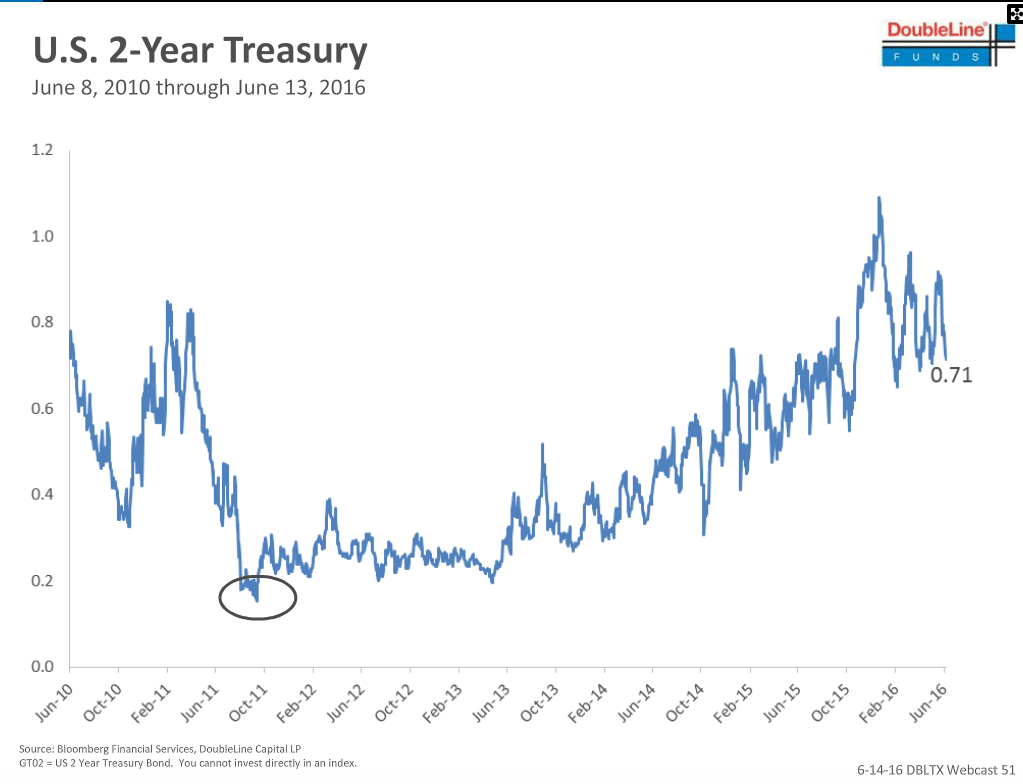

As I have stated several times in my outlooks, I believe that the global sovereigns are putting in a yuuuuuge, massive, monstrous top in prices, another words, a bottom in yields, but that the shorter term yields will bottom first, followed by the longer term yields with a long lag. Please refer to the first two charts below, courtesy of Jeff Gundlach of Doubleline Capital. You can see the 2 year treasury yield bottomed in Oct 2011 with a yield of .15%, and the recent high was in Dec. at 1.1%. However, the 10 year didn’t bottom (at least so far) until July 2012 with a yield of 1.6% with the recent high being 3.05% in Jan. 2014. And the next 2 charts are the 5 year yield and the 30 year yield with the charts spanning ten years and showing what I believe is the massive bottom in yields. You can see the 5 year bottomed in July 2012, while the 30 year didn’t bottom (so far) until this past Jan. You can see the bottoming lag occurring from the 2 to the 30 years. And I said when referring to the bottoms “so far” because there’s still a good shot for both the 10 and 30 year yields to put in one more spike lower low bottom, (which I call a technical spring), as we get one more deflation scare. You can refer to previous outlooks for more details where I talked about that.

So why should we even care about all of this? Because this is exactly why I am so frightened for our future and why I want people to start preparing immediately. The destruction of the environment of complacency and total ignorance of how debt even works in society is going to have profound effects on all of us, including many industries, and all financial markets. The massive bear market in bonds will have huge ramifications for all of the industries which have relied on debt since this debt orgy started after WWII. All of you can figure out which industries that would include, but certainly real estate, college, all consumer items, etc. And the positive effects on the stock markets, precious metals, and commodities will be enormous.

There’s plenty of other effects that I haven’t even begun to understand yet, so please let me know your thoughts about that.

'Trader Scott – The Chicken or the Egg and Why Should We Care? – June 16, 2016' have 11 comments

June 16, 2016 @ 12:13 pm Dave

Scott

Could you please explain how real estate investors will be impacted in the coming years. Should we be seeking to take on the now very low interest debt or avoiding any investment that will be have to be sold in a future more difficult debt market.

Thanks,Dave

June 17, 2016 @ 3:47 pm scott

Even tho in 2012 I did turn fairly bullish on RE expecting a bear market rally, my outlook for RE and all industries that rely entirely on debt creation is bearish long term. Before the widespread push for 30 year mortgages, renting was commonplace in the US. The huge rise in the percentage of all cash RE purchases is no fluke. I expect that to continue growing. So all industries that expanded via credit are now set to see the exact reverse. If I were bullish on RE prices, I would want a good chunk of my capital in RE, but I’m not. My focus for long term investments (not necessarily trades) is to accumulate PMs, agriculture and eventually stocks — but ONLY, repeat ONLY into extreme price weakness.

Does that help Dave?

June 19, 2016 @ 3:02 pm Dave

Scott

Thanks for the reply.Yes it did help confirm some things. Inflation will increase prices and decrease buyers. In the inflation of the seventies a single family house increased nicely in price but was actually much more a store of value than a profit machine once purchasing power was factored. Maybe we should talk about that subject.I would like to hear your approach.

Dave

June 20, 2016 @ 10:32 pm Scott

I’m doing a lousy job of explaining myself Dave. i apologize. We are in an age of deleveraging which has much much further to go. My belief is that the leverage everywhere that catapulted prices (costs) higher is set to work in reverse. You can see the deleveraging taking place in real time via the proliferation of all cash transactions We’re not going to have 1970’s style inflation, possibly a sort of-ish combination of 1970’s/1930’s.

The only interest that I have in RE is a VERY modest place to live. I’m not interested in a store of value, I’m in this business to make money, otherwise the RISK is very much not worth it. It’s actually very simple. If you believe that RE prices are in an uptrend, then absolutely, you should want to own plenty of RE. I believe the opposite.

June 17, 2016 @ 1:57 pm John

Hi, What would be the best way to short bonds?

June 17, 2016 @ 4:00 pm scott

Unless you’re a skilled and experienced trader do NOT short bonds. At times I’m short bonds, but I do not hold it long term (in fact I never short anything as a long term hold), only as a trade. I sometimes use the TBT ETF. But that instrument should only be used as a trade. The best way to short bonds with a longer term time frame is to buy PMs, agriculture and eventually stocks, all of which will see tremendous capital flows during a bond market destruction. But ONLY buy these assets into extreme price weakness.

June 22, 2016 @ 10:57 am Pete

You say buy PMs into extreme weakness. How would you characterize the current price of PMs? Do you think they are a good buy? Or do you think we should wait for a pull back? If you believe a bond crash is on the horizon, Now would seem like a good time to buy PMs.

If a bond crash occurs. Stocks should rise especially the miners. We are seeing the beginnings of that trend now. I would think realestate would drop at least initially. I think realestate still has a lot of leverage and the leveraged buyers will drop out of the market. Banks won’t be able to lend. Love to hear your thoughts.

June 22, 2016 @ 7:28 pm scott

Pete – success in markets comes down to one word — RISK. So everything that I do in markets starts with that and it’s why I ONLY buy into extreme weakness. It’s the only way I know how to do this business. So my strategy for RISK control involves 3 main steps (and several smaller steps to fine tune the timing further).

#1) What is the TREND of the market. #2) If the TREND is up, wait patiently for the selloffs. #3) Identify the support areas and step up to the plate into the emotional selling.

You asked “If you believe a bond crash is on the horizon, Now would seem like a good time to buy PMs.”

That is not a reason at all to buy PMs. I’ve believed that a bond crash is on the horizon for several years, but I specifically advised several times on Patrick’s show to avoid PMs. That advise changed in Dec. 2015.

So be careful trying to tie any markets together too closely. The main focus should be on the individual market itself.

The technical structure of the gold market was not conducive for new buying for 4 years.

And yes i agree with you about RE, but I think it’s more a thing where the potential buyers can’t buy, rather than the lenders can’t lend.

June 15, 2017 @ 4:30 pm Interest Rate Increases Are Bearish For Gold - Right?

[…] why is this so important now? Almost exactly one year ago, my post described how a very convincing final bottom in yields could set up beautifully, which Treasury yields did “accomplish” on July 6th, 2016 […]

July 23, 2017 @ 11:30 am Interest Rate Increases Are Bearish for Gold - Revisited

[…] year surge into 1981, when the 30 year yield topped at 15.2% on October 26. And one year ago the final “spring” bottom in bond yields set up beautifully with the 30 Treasury yield hitting 2.1% on July 6th, 2016 (arrow). This was the […]

January 9, 2018 @ 5:00 pm The Big Bond Bear

[…] year surge into 1981, when the 30 year yield topped at 15.2% on October 26. And one year ago the final “spring†bottom in bond yields set up beautifully with the 30 Treasury yield hitting 2.1% on July 6th, 2016 (arrow). This was the […]