Short Term Silver

Trader Scott’s Market Blog

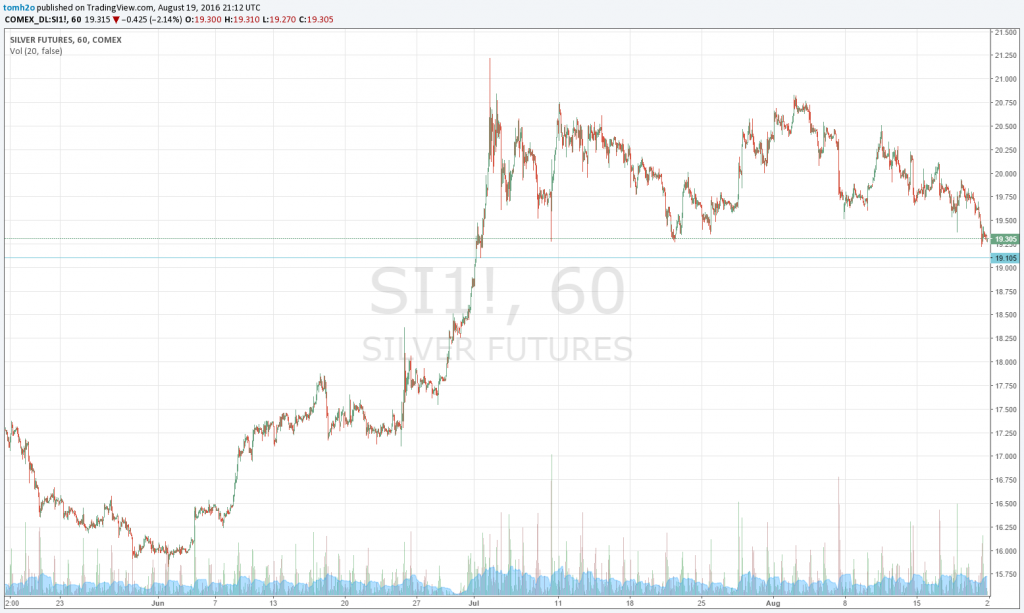

As a free service, I can’t/won’t give specific trading advice. The chart below shows the shorter term view of silver futures, which is a market that I’m interested in on a trading basis. One of my favorite trades is a market that’s in a fairly clearly defined TRADING RANGE/SIDEWAYS TREND. The accompanying chart shows that the upper side/RESISTANCE is around $21 and the low end/SUPPORT is around $19.20.

I always buy into weakness. The majority of people get scared when a market is falling. They then get bearish and they’re afraid that the market is going to go below the SUPPORT area and then keep falling. That particular situation is actually one of my favorite entry points into a trade or investment. That’s because I understand/respect/believe in SUPPORT and RESISTANCE areas. So when a market “breaks a SUPPORT area”, I actually will often step up and buy (dependent upon the technical price vs. volume situation at that time). If the technical structure of that market is showing the downside pressure is abating as it trades in its’ RANGE, then a “break of SUPPORT” is a very low RISK/high PROBABILITY entry point into a market. And conversely it’s a situation when most people think it’s the worst time to enter. The great Richard Wyckoff called this particular situation a springboard entry point.

'Trader Scott – Short Term Silver – August 21, 2016' have 3 comments

August 21, 2016 @ 4:51 pm Randal Magnuson

Lovely… Thanks!

August 23, 2016 @ 6:18 am Julian

Hi Scott, thanks for the article, it was quite relevant to me. Armed and dangerous after reading Volume and Price Analysis by Anna Couling I set aside some money for short term trading practice. Basically, I am I quite unsure of myself at this stage in terms of volume, price analysis. Yesterday I bought USLV(bull 3x silver) when it fell over 6% as a short term trade. After this purchase, I stumbled on your article and it made me feel somewhat better about the trade as your analysis of the silver range was somewhat similar to mine. Anna in her book noted how support and resistance are not concrete barriers but more like rubber bands. Now the hard part, when do I sell … Thanks again for the analysis….

August 24, 2016 @ 12:31 am traderscott

More great insight from one of our readers. Julian, that’s a great description of SUPPORT and RESISTANCE (ZONES) .

And don’t fret, I’m still often unsure of myself after all of these years of experience. This is not a business of certainties. It’s actually a business of total uncertainty – it’s only about PROBABILITIES. It’s one reason that so many fail at trading – they can’t handle the omnipresence of uncertainty.

But just be aware Julian that any triple leverage ETF is for short term trading only. You should be looking for the exit, profit or loss, as soon as you get in. One of the main ways to survive as a trader is to be looking to take at least partial profits (if available) very quickly after entering – and then moving your stop up to break even for the rest of the position. And as you get better as a trader and timing markets, you should have profits very soon after entering the trade. In fact almost instantaneously.

So yes for silver currently, “they” are going to try and stretch the SUPPORT ZONE as low as they can, that’s what a “spring” is regarding markets.