The Breakup Song

I’m going to discuss the European divorce today. The 1981 hit “the Breakup Song’ from the Greg Kihn Band is an apt song currently.

https://www.youtube.com/watch?v=VLFfSDEA26o

I believe that the chatter being spouted regarding the apparent breakup between the Eurozone and Britain is just noise. The reason is that Brexit is just another symptom, not the cause of anything. Is it that hard to understand? It’s just a symptom of the crushing global debt load that the world has built up over the last 80 years. But of course, all of the usual clowns are out once again to claim that now Brexit will cause the economy to collapse and stock markets to crash and gold to soar. Once again Brexit is a symptom, not the cause. All of the trends were in place before Brexit . Nothing has changed. In the pre-Brexit post entitled “Anticipation”, I explained that the way I keep sane and have the ability to act rather than to react, is by being prepared and also by having a plan. That plan depends on the TREND of the market – specifically, I believe that the TREND in stocks is down, the TREND in gold is up, and the TREND in the US$ is up.

So what was my positioning going into Brexit : short US and European stocks in my trading account. And in my investment account: heavily long gold and the mining stocks, heavily long US$ split between cash and US govt. bonds, and a long position in agriculture via the RJA ETF. And my strategy going forward hasn’t changed one bit. The only thing that I’ve done post-Brexit (besides some very short term trades) was to cover my short position in Europe via the ETF symbol FEZ. (Also my favorite Steely Dan song.)

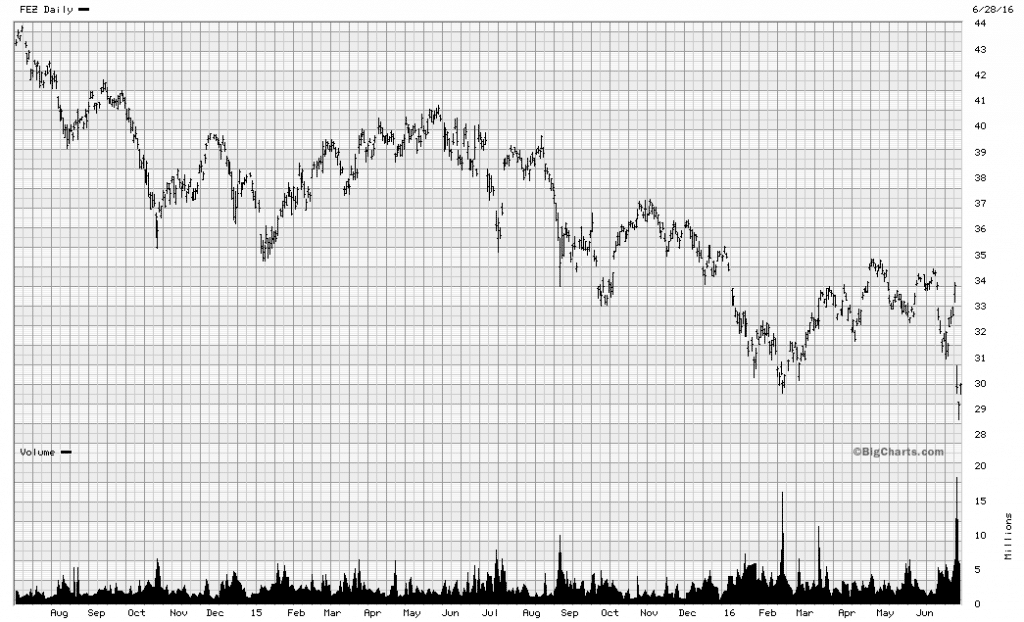

And for those asking questions about my constant repetition about SUPPORT areas – here’s a real world example. As you can see from the first chart below of FEZ, the lows around $30 between Jan. to March, with the spike in volume – that’s your SUPPORT area. That’s the area that I was targeting to cover my short position. The market gave me that opportunity on Monday and I took it. I had a plan and I was able to act, instead of reacting. Going forward, I will re-short it into strength, if the opportunity arises.

As to the second chart below showing the three year chart of the Dow, you can see that for the last 18 months there’s been a range between 15,500 and a bit above 18,000. I believe that it’s distribution – meaning a topping process, and I’m still short. I will look to cover into more weakness, or short more into strength.

As to both gold and the US$, I believe that they’re both in UPTRENDS, and I’m waiting to buy more, if the opportunity arises. Meaning buying into weakness. As to agriculture, that’s the one that’s getting interesting, If we see one more selling wave with decreasing volume, that’s a potential opportunity to buy more.

And lastly, to the latest mantra claiming “you see Brexit is going to cause stocks to crash and the economy to collapse”. That’s so misguided. They think that stocks are going to crash. A large selloff is possible, but stocks are no way in a bubble, The collapsitarians are looking at the wrong market to freak out about. It’s when the global bond market begins to crater – that should be their focus. And early signs should appear second quarter next year coinciding with helicopter money.

So please develop a plan for yourselves and your families – it’s going to get very ugly beginning this fall and beyond. Like in the movie “Under Siege 2”, we’re all on a runaway locomotive with no possibility to stop it.

'Trader Scott – The Breakup Song – June 29, 2016' have 5 comments

June 29, 2016 @ 12:59 pm Michael Harvey

The British people have rejected the arrogant rule of the EU superstate and the tyranny of its unelected courts, commissions and bureaucratic overlords.It will strengthen Britain’s position in the future. I am buying precious metals ETF’s and bullion.

The increasing desperation of Central Bankers and their willingness to boost inflation at all cost is going to lead to a plethora of unintended consequences, all of which are likely to boost the gold price.

Keep up the good work Tom.

Regards

Mike Harvey

July 3, 2016 @ 11:03 am Tom K

Hi Scott,

Thank you for letting us look over your shoulder to see how you trade the markets. I find it very informative.

I was particularly interested in your view that the US$ is up. I have heard many pundits talk about the possibility that the US$ may lose its status as the world reserve currency in the coming years. If that were the case, it would seem that the US$ would trend lower in the future. After hitting a multi-year high around 100 in January and a low of 92 in May, it has spent most of the last three months below 95. Could this be a down trend retracement?

I would appreciate your comments on the US$.

Please also include how you think the US$ might do against the Japanese Yen in the coming months and years. The yen has been gaining strength since August 2015 and strengthened further in reaction to Brexit.

Thanks for sharing. It is appreciated.

July 3, 2016 @ 6:57 pm Trader Scott

Good questions in there Tom. I’ll answer them in a blog post soon with charts, since there are several layers to the response.

June 30, 2016 @ 12:07 am Scott

Good song and very accurate analysis. Yes, nothing in Government happens by accident. Man. It’s crazy out there.

July 4, 2016 @ 9:48 am patrick

Well, as Neil Sedaka said, “Breaking up is hard to do” Thanks Scott for your work here…great stuff.

Now on TEXIT

We Texan’s have often thought of cutting the string with D.C. And it is actually in the Texas Constitution that we can get gone whenever we want. Of course D.C. would absolutely get their panties in a wad.