Bonds Are a Good Buy, or Maybe Not

April 8, 2017

Trader Scott

The following article from Bloomberg is a perfect example of how both to struggle in markets and to be in a constant haze. Yes markets are extremely difficult to navigate pretty well on a day to day basis. There are daily, hourly, minute(ly) gyrations to deal with which can throw off all of our assumptions/outlooks/plans. And it’s the “job” of a short term trader to take advantage of those gyrations (volatility) to attempt to pull out net profits over time. But no matter what the trading or investment time frame, solely focusing on where a market is going just doesn’t work. There are tons of unforeseen and completely unknowable factors which will always come into play. So it’s the entry point in price and time which is the important thing. We have zero control over the outcome, only on where we buy (or sell). Yes we should approach and develop a good outlook on markets, but it’s only our interpretation of the situation today, yet things change which may set up another opportunity. Markets don’t go in one direction every day or every month.

The bond market is extremely bearish long term, but the incredible amount of bearishness on bonds in early December was an eye opener, with calls for a bond market crash all over the place. This was at the same time when US Treasuries had a series of selling climaxes, and the weak hands had record short positions. This was all chronicled in some posts at the time like this one when a very good opportunity had arisen for me to take the other side and go long. It was just an opportunity, not a focus on the outcome. Here was the chart posted back then when the Trump reflation trade was being extrapolated to infinity, as was the “new US$ bull market”. Fast forward 4 months, and the bond market certainly did not crash (yet) – when it was a sure thing to sell, sell, sell. The brand new $ bull market was not about to soar – buy, buy, buy. The extrapolation crowd was in full force. And here we are now with the doubts arising about the certainty of reflation. Getting caught up in the news and the consensus is deadly. It completely distorts and sways our ability to let the market come to us, and to potentially “reveal” an opportunity.

So the “jobs” report came out on Friday, and it was a miss. And on Bloomberg in the video link, they are debating (guessing) whether yields are going higher or lower. In other words they are attempting to decipher the outcome, and using a meaningless report as one of their tools. Their attempts will go nowhere. It’s pure guestimating. Where were these people back in early December when a good long side trade (opportunity) was setting up? Now they’re trying to figure it out. And they’re doing this when bonds are in a horrible spot to take a long position, right near the top of the range – a lousy opportunity.

The world’s biggest fixed-income managers aren’t ready to give in to the bond bulls just yet.

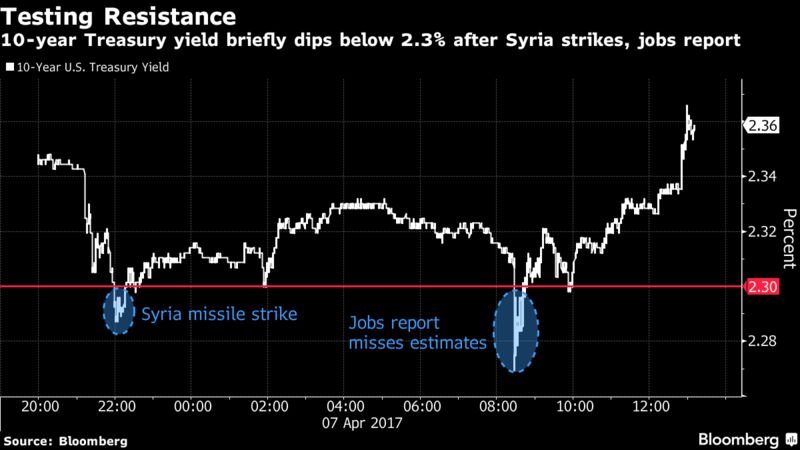

Even after Friday’s weaker-than-forecast U.S. payrolls report, Treasuries failed to sustain a rally that briefly pushed yields to 2017 lows during the New York session.The day’s fluctuations merely leave 10-year yields at the bottom of a range they’ve been trapped in all year — and above their lowest year-to-date closing level of 2.31 percent.

Investors and advisers at Allianz SE, BlackRock Inc. and Janus Capital Group Inc., which oversee almost $6 trillion combined, see limited potential for lower yields astraders debate the fate of the global reflation trade. The March labor data provided some support for a rosy outlook, in the form of on-target earnings growth and the lowest unemployment rate in almost a decade.

“Interest rates themselves are already very, very low, and I wouldn’t expect something like this to continue to push interest rates lower,†said Bill Gross, who runs the $1.9 billion Janus Global Unconstrained Bond Fund.“The focus really for economic growth going forward is not necessarily job growth but productivity growth.â€

Treasuries are set to wrap up a four-week rally that’s brought them back from the brink of a bear market, at least as defined by Gross back in January. That’s when he said 10-year yields would have to hold above 2.6 percent on a weekly or monthly basis to mark the beginning of sustained losses. Last week, he said that level could come “under siege†if other central banks step back from quantitative easing or the U.S. advances fiscal stimulus. Neither development appears imminent.

The bond market has shown greater skepticism toward the reflation trade than equities, with U.S. rates mostly unchanged through the first quarter even as stocks surged.The Fed’s signals that it intends to raise rates further have helped put a floor under yields.

Fed View

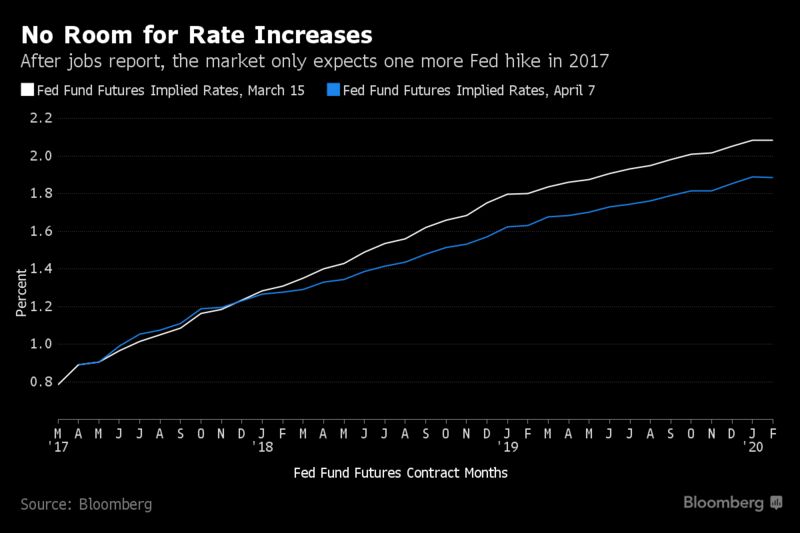

Even after the March data miss, bond traders left their Fed bets mostly unchanged.Implied rates on fed fund futures fully price in a September hike, and don’t rule out the possibility that the Fed could raise rates in June and again in December.

“This does not change the Fed’s trajectory — the economy is growing at a decent level,†said Rick Rieder, chief investment officer of global fixed-income at BlackRock.“Interest rates can move higher.â€

Even as yields edged higher on the day in the New York afternoon, the benchmark 10-year note is closer to overbought territory than oversold, according to relative strength index analysis.

“At this stage, I would be careful going long the bond market,†saidMohamed El-Erian, chief economic adviser at Allianz and a Bloomberg View columnist. He said he wouldn’t call March “a weak jobs report,†given recent levels of employment gains and wage growth.

'Trader Scott’s Market Blog – Bonds Are a Good Buy, or Maybe Not – April 8, 2017' has no comments

Be the first to comment this post!