Turmoil in Europe/Waiting for Opportunities

Trader Scott’s Market Blog

February 22, 2017

The political turmoil in Europe is continuing. The Euro is in a major downtrend, while the $ is in a major uptrend. This won’t last forever, but it’s in force currently. A coming break below par on the Euro with ending action, would be an area with the potential for a tradeable rally. The $ continues in a major bull market, notwithstanding Trump’s totally useless attempts to talk the $ down.These attempts will fail until the $ puts in a major top – and that is coming. The technical situation currently is an intermediate downtrend/re-accumulation within a major uptrend. And the support and resistance levels are laid out here. I left several comments (beforehand) about the 99.40 level as being the first high probability level for the end of this intermediate downtrend. Meaning, a break below 99.40 with ending action would be a high probability/lower risk entry point back into the $. When the USD was smack into the big resistance area there were many clowns who were proclaiming the “new Trump $ bull market”, while my view was totally opposite then. They were spewing that nonsense right into the 103 resistance area in the $. The intermediate downtrend shut them up, but they’ll be back and probably right in time for the next top.

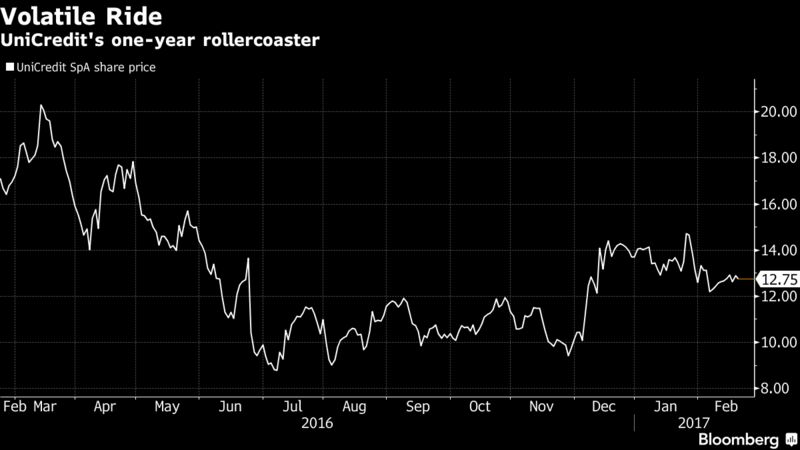

In the meantime, the downtrend in the Euro continues, and it will generally help the equity markets (priced in Euros). And we can see the problem for overseas investors in Italian stocks, for example – looking at the performance of the US$ based ETF for Italy – EWIvs. the Italian MIB. So the volatile political situation in Europe could create some great opportunities for entry points into European shares, and a bottom in the Euro/top in the $ could be an extra for overseas investors. There are some asset managers already bullish on Italy, but it’s way too early for me, and am waiting for it to play out:

Ignore Italy’s seemingly endless political turmoil and you’ll see the value in Italian stocks, according to Amber Capital UK LLP.

The resignation of former Italian Prime Minister Matteo Renzi as leader of the ruling Democratic Party is blinding investors to attractive bets on the company’s equities market, said Giorgio Martorelli, a portfolio manager who helps oversee about $1.4 billion at the London-based hedge fund.

“This is not new for Italian companies,†he said. “Notwithstanding political instability, many of them have delivered outstanding results. There is a huge underweight in the market driven by political noise around the Democratic Party.”

Amber Equity Fund, which has delivered a 2.1 percent return this year, focuses on industries in which consolidation among mid-sized companies could create value. That includes banks, local utilities and some government-backed companies, Martorelli said. Amber prefers Italian and Spanish stocks to their French and German peers, he said.

Banks Bets

In banking, the fund owns stocks of Bper Banca SpA and Banco Popolare di Sondrio and took part in the capital increase of UniCredit SpA, Italy’s biggest lender, earlier this month.

“UniCredit is a very liquid bank and the new management team has presented a very credible turnaround,†he said. “This is the most interesting restructuring case in southern Europe.â€

The optimism toward Italy’s ailing banking industry is rare among equity fund managers. The Italian government is working through a rescue of Monte Paschi di Siena SpA, a number of smaller banks have had to call upon state aid and lenders are weighed down by about 360 billion euros ($382 billion) in troubled loans.

“Political uncertainty remains, as seen again this weekend, and as a result we are mindful of more domestically focused areas of the market with financials offering good value but still carrying most of the political risk premium,” said Diego Franzin, head of European equity at Pioneer Investments in a separate interview.

In other industries, Amber is optimistic about small local utilities including A2A Spa and Ascopiave Spa, a sector in which Martorelli foresees potential mergers and acquisitions.

The fund also owns stocks of Anima Sgr SpA, one of Italy’s largest asset managers which has announced a partnership with BancoPosta Fondi SGR. The deal is expected to be completed in the first half of the year.

Though companies have proved resilient to the constant political turmoil, Amber has a clear preference regarding the outcome of the current situation, Martorelli said.

A year from now “we are hoping for a stable political landscape with snap elections and the Democratic Party gaining a majority,†he said. “If this doesn’t happen, a fragmented parliamentary landscape, in which Italian companies have been operating for the last 20 years, would be preferable to a populist Five Star government which would be seen by investors as a brake for structural reforms the country needs.”

About

'Trader Scott’s Market Blog -Turmoil in Europe/Waiting for Opportunities – February 22, 2017' have 16 comments

February 22, 2017 @ 3:34 pm Dan

“The Euro is in a major downtrend”

Indeed, both gold and silver priced in euros have climbed back to their levels before the U.S. presidential election in November, erasing the drop that followed the vote.

Very good blog, btw.

February 22, 2017 @ 4:00 pm traderscott

Dan these guys out there with their fancy methods (that no one can understand) and their stupid predictions – this business is about doing the work. From my 1/7/15 post : “Blah, blah….For years I have been on this show saying gold would not hit its major low until Sept. 2015. We’re getting closer to that time and now people need to be watching the outperformance of gold vs. all the Components of the USD index. This is important going forward as I remain very bullish on the Dollar. Presently gold is ripe for a selloff, but selling waves will continue to see big demand step up. PATIENCE.” So since the 12/17/15 low in gold, both gold and USD are both….up. All of these theories about supposed correlations in markets work….until they don’t work. So they do all of these calculations, for what reason. The break in the correlation is usually around the great entry points.

February 23, 2017 @ 8:52 am David V

The unemployed are out buying metals in droves this morning.

February 23, 2017 @ 9:05 am traderscott

I’ve been unemployed for over 20 years, but I’m certainly not buying gold this AM.

February 23, 2017 @ 9:00 am traderscott

Gold is “breaking out” this AM. Markets are just about waiting for our opportunities and stepping up when they arise, and not guessing/predicting what the outcome will be. In an uptrend things go up. Period. There was another SPRING yesterday in the miners – I did a live video, but it’s lost in the ozone somewhere. The other videos from yesterday are sitting at the new site.

And the NAK stock which some of you have discussed – there has been a shorter term selling climax. Now it’s just about giving it time, as there has been a lot of technical damage.

February 23, 2017 @ 9:11 am traderscott

And the totally dispassionate view, short term the miners are right back closing into resistance pre-market.

February 23, 2017 @ 9:20 am Jon

Comex open today. Taking out the shorts now, next move will take out the longs. gotta sell this move…

February 23, 2017 @ 9:20 am Jon

Comex opex (not open).

February 23, 2017 @ 9:21 am traderscott

Jon, at the new site you’ll be able to edit your own comments.

February 23, 2017 @ 9:54 am traderscott

And I’m selling out some of a short term trade now into strength.

But as long as gold can stay under control, and not get too emotional, it will keep the weak hands from screwing themselves up. It was my point with the recent post about manipulators to the rescue.

February 23, 2017 @ 11:10 am Easy Al

Hi Scott,

Give us the link of your new site so that can help you to test and improve it.

February 23, 2017 @ 12:30 pm traderscott

Let me think about how to do that.

February 23, 2017 @ 11:29 am Jon

Short squeeze complete, now for the longs…

February 23, 2017 @ 12:03 pm David V

First Solar, coulda, shoulda, woulda.

February 23, 2017 @ 12:22 pm traderscott

You have ESP, just writing this:

These solar stocks I’ve been harping about with the selling climaxes last year, and all of the SOSes coming in, and use the weakness to buy. I listed several symbols. Well just like the ag stocks got overdone on the upside a few weeks ago, and I trimmed back, now it’s the solar stocks. I’m very bullish long term, but it’s time to cut back into this buying panic. Someone else can take my shares from here. And I have a limit to sell all my shares in FSLR at 37.75.

February 23, 2017 @ 2:39 pm traderscott

The $ has formed a fairly powerful resistance at that 101.74 area, which is the area where hedge funds would begin to come back in on a “breakout”, mainly short covering at first. The $ is still in a major uptrend, the intermediate term reaction is strengthening it, not weakening it. In an uptrend, the backups strengthen a market. It’s about believing (or not) in the overall trend of the market. And within the current overall re-accumulation area, you can see the waves within this area, which can be viewed with the shorter term trend channels.